City of Martin to consider budget proposals this afternoon

By Sabrina Bates

MVP Regional News Editor

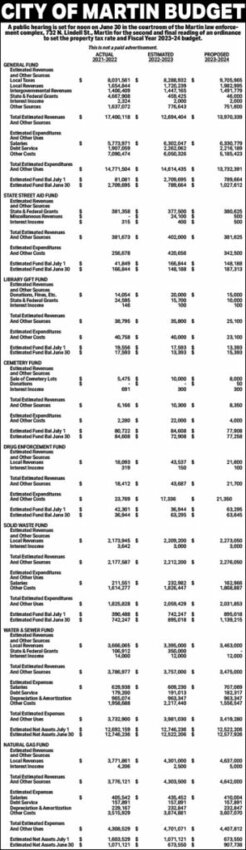

This above photo is a copy of the City of Martin's first proposed budget for the Fiscal Year 2023-24 that was rejected on its second reading by the Board of Aldermen on June 30.

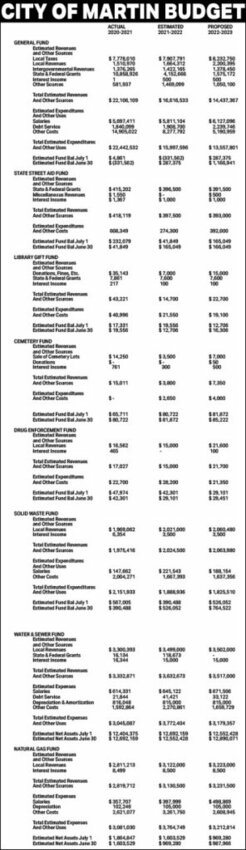

The photo above is the City of Martin's advertised budget for Fiscal Year 2022-23.

The City of Martin Finance Committee will consider budget options for Fiscal Year 2023-24 (July 1, 2023 - June 30, 2024) after an original proposal was shot down by the Board of Aldermen on June 30. The proposal would've set the property tax rate at $1.75 per $100 of assessed value for property owners and businesses. As this is a property reappraisal year for Weakley County, the state board of equalization issued a new certified tax rate recommendation of $1.24 for municipal property in the city limits of Martin. Weakley County properties are reassessed every five years. The last countywide reappraisal was 2018. The Comptroller's Office of the State of Tennessee notes cities or counties wanting to exceed their recommended certified tax rate need to provide notice of a proposed tax rate increase to its citizens and hold a public hearing.

Several citizens expressed concerns to board members during the city's second and final reading and public hearing of its fiscal year budget on June 30 that would set the tax rate at $1.75 per $100 of assessed property. Residential property owners pay taxes on 25 percent of their property values. Agricultural land is also taxed at 25 percent, while business owners pay taxes on 40 percent of their property values. For example, a residential property valued at $200,000 is taxed on $50,000. At the $1.75 rate, that property owner would pay an $875 annual property tax to the City of Martin, in addition to county property taxes. A business assessed at $200,000 would pay taxes on $80,000. At $1.75, the property tax owed to the City of Martin would be $1,400.

Following June 30's dissenting vote and an announcement the city would draft other budget options, correspondence released by Freelance Consultant Lynette Wagster and Martin Community Development Director Brad Thompson, who shared the correspondence was dialogue from Martin Mayor Randy Brundige during a recent Finance Committee meeting, if the proposed budget was not approved, community events through 2024 are halted and "results in understaffed police and fire (closing of fire station 2) placing General public safety at risk.

Brundige later explained events aren't canceled, but the planning of those events are halted until a new Fiscal Year budget for the city is approved. According to the correspondence, the state-recommended tax rate of $1.24 reduced the City's property-tax collections by $150,000. The released information also claims the initial budgeted tax rate of $1.75 (initially approved by the city's Finance Committee and the Board of Aldermen) increases the City's overall budget by $1.2 million. That $1.2 million was suggested to cover an increase of $135,000 in health insurance benefits, a projected $555,000 net loss in business taxes, a 3 percent employee pay increase, no layoffs of city employees, funds community events and prevents future increases over the next few years. According to the board of aldermen, the last time the city's property tax rate increased was post-COVID.

The City of Martin Finance Committee will meet at 5:15 this afternoon (Monday, July 17) in the courtroom of the Martin Police Department to consider other budget proposals.

A new budget proposal is expected to be presented to the full board of aldermen at 5:15 p.m. on Tuesday, July 18 in the city courtroom. A second and final reading, as well as a public hearing, of the proposal is set for 5:15 p.m. on Monday, July 31. All meetings are open to the public.

Below is a copy of the actual City of Martin operating budget from Fiscal Year 2020-21; FY 2021-22 and FY 2022-23.